This Economy Needs Some WD-40

The grinding and squealing you hear is the global supply chain beginning to get its wheels in motion again. The system of suppliers, manufacturers and distributors is akin to a large, heavy locomotive. It takes a while before it can get moving at full speed, especially after Covid-19’s “derailing” events, which have left inadequate production processes scrambling to satiate robust consumer demand as the economy emerges from the pandemic. Raw material and labor shortages, lingering movement and capacity restrictions, extremely long lead times to receive virtually anything, and inventory and cost inefficiencies are just a few of the challenges gripping the global and U.S. economies.

The fast-acting lubricant could come in handy to limber up many of these supply-side bottlenecks.

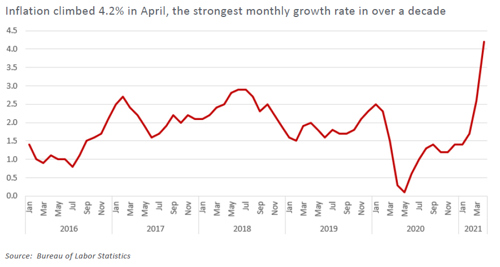

It could also go a long way towards mollifying another side effect of the supply-demand imbalances: higher inflation. Many companies have elected to pass along to consumers the higher fares they are seeing for product inputs, labor, and freight to avoid compressing margins. This “pass through” action contributed to the Bureau of Labor Statistics’ Consumer Price Index (CPI), which gauges what consumers pay for goods and services, reaching its highest level in April in more than a decade. Indeed, April’s CPI grew 4.2% year-over-year, the strongest monthly growth rate since 2008. Stripping out the volatile food and energy categories, the “core” CPI index rose at the fastest clip (+3.0% in April) since the mid-1990s.

While early, consumers have taken the recent price increases in stride, thanks to pent-up appetites for travel and other re-opening hedonism, supported by improved vaccination administration, and flush pockets from savings and federal stimulus measures.

However, a different case can be made for investors. The magnitude of April’s price gain has stoked a level of fear among investors, including our client base, and prompted some to cite the market may be on the precipice of a period of persistent, above 3% inflation. If proven true, that scenario may force the Federal Reserve to tighten the extremely loose monetary policy measures sooner than otherwise. All else equal, measures to stave off inflation, including raising the discount rate, could pressure prospective returns for risk assets.

Undeniably, inflation is running hotter right now. That said, we, along with federal authorities, believe above-3% price gains to be transitory rather than marking the beginning of a new, accelerating price cycle.

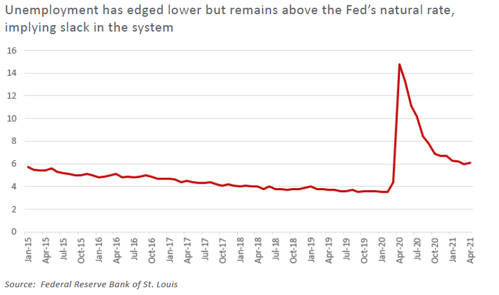

A few dynamics give us comfort in that forecast. First, we recognize the relatively short-lasting impact of supply-side bottlenecks. Unfortunately, there is no quick, WD-40-like fix to the current situations; however, we believe it is only a matter of time before global supply chains catch up to consumer demand, which may cool as the “sugar high” from recent government stimulus checks wears off. Second, the expiration of federal supplemental unemployment insurance in September may motivate the disinclined to return to the workforce and fill the record number of job openings (8.1M) recently cited by the Department of Labor, further helping supply challenges. For reference, we note April’s 6.1% unemployment rate remains above the Federal Reserve’s natural rate of employment (4-5%), or the lowest level employment could reach without creating inflation.

Simply put, prospects for improved supply, the run-off of consumer stimulus support and meaningful labor market slack may be enough to return inflation below the 3% mark within the next several months, quenching concerns of an over-heating economy.

Then there are the powerful disinflationary forces impacting society, including an aging population, which tends to place a governor on long-term economic growth (and inflation), and technology-driven efficiencies that afford automation and enable price discovery. We believe these long-lasting dynamics will continue to support a relatively low inflationary environment for the next several years.

Interestingly, the market appears to share our view that above-3% inflation is transitory. In fact, five-year Treasury Inflation-Protected Securities (TIPS) are discounting inflation of roughly 2.6% over the concurrent period. While that figure is above the past five years’ 1.8% average inflation rate, it falls essentially in line with the high end of that 5-year trailing range: 1.2% to 2.5%.

We believe our clients’ portfolios are positioned appropriately for a moderately higher inflationary environment. In short, we continue to recommend investors maintain a healthy equity allocation, appropriate for one’s risk tolerance and required return. We remind investors a company’s earnings are nominal, meaning they participate in the pricing and purchasing power of that company.

Broadly, our stock selection process is rooted in judicious evaluation and research of companies that maintain good pricing power, evident by strong and consistent gross margin performance, including during periods of inflation bouts, and/or possess a track record of product innovation. These inclusion criteria, in addition to maintaining a basket of stocks with a reasonable amount of commodity exposure, including to energy, agriculture, and mining markets, afford our clients’ portfolios natural hedges against rising inflation.