During Stock Market Turbulence, Think Like a Kid

Kids are focused on the fun things: attending birthday parties, playing games, building forts and, of course, consuming as much junk food as possible. It never even enters their mind to consider the direction of interest rates, economic growth expectations or stock market volatility. Kids are oblivious to the many dynamics that can cause us adults to squirm. Their emotions hinge on what variety of cookie is available or whether school is open or closed – and not the day-to-day or minute-to-minute changes in the value of an investment account. The unpredictable and erratic up, down, up, down movements in the market indices can make even the most stoic investors revert back to childhood temper tantrums (at least in their minds) – actions that solve little and, more often than not, create additional problems. So, during periods of heightened market volatility, it could help to think like a kid: focus on the fun things – family, health, hobbies – anything but the daily headline “noise.” It is important to keep investment emotions anchored to one’s long-term plan, which rarely warrants alterations following short-term market movements.

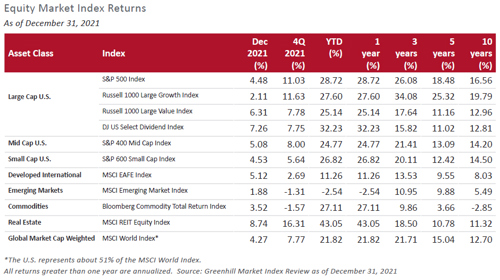

In the wake of a year that saw the S&P 500 move “up and to the right” in a seemingly uninterrupted manner, 2022 has witnessed increased volatility and sessions of intense selling pressure. After all, January wrapped up the worst month for stock price returns since March 2020. Not even the Blue Chips Apple and Microsoft have been spared from the Bears putting them in “time out” for a period. As of this writing, the S&P 500 has slipped near correction territory, down roughly 7% for the year-to-date period. The technology-heavy NASDAQ Composite index has fared worse, down 10% year-to-date and roughly 12% from its peak reached in November 2021.

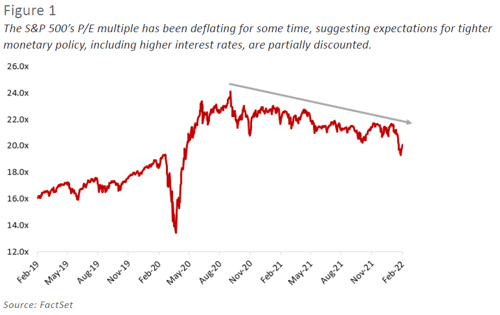

What has caused the abrupt change in market sentiment? We surmise the most likely culprit has been the upcoming gradual removal of the Federal Reserve’s easy money policies, which have benefitted stock valuations (and prices) for the past 18 to 24 months. We note the Fed has been winding down its bond buying program for the past few months and is widely expected to begin raising interest rates later this spring. While normalized (i.e., higher) interest rates typically signal a stronger economy, expectations for higher market rates have placed downward pressure on stock valuations (and prices).

Why would higher interest rates be problematic for stock valuations? Financial theory states a company’s stock price is the summation of all future cash flows (i.e., profits), discounted to the present at an implied interest rate. All else equal, raising the interest rate in the discounting formula results in a lower present value (or price) for the stock. Market valuations are simply “re-rating” to the new, higher (or less low) interest rate regime.

This valuation “adjustment” process could take many months to fully unfold and, while it is difficult to point to a market bottom, we believe investor expectations for higher interest rates are, at least partially, discounted. In fact, the S&P 500’s 12-month forward P/E (Price to Earnings) multiple has already “deflated” to about 20.0x from 21.5x at the start of 2022. The current multiple compares to the S&P’s 19.3x multiple prior to the onset of the pandemic and the commencement of easy money policies. (Please note, our discussion has been limited to interest rates’ impact on the “P” in the P/E multiple; it remains unclear how higher interest rates (and the economy’s demand for money) could impact the “E.”)

In any event, it has been some time since investors have dealt with any significant stretch of market volatility. And, while painful, we remind investors that periodic market corrections, regardless of the rationale, are typically viewed as normal and, to some extent, healthy over the course of the business cycle. Simply put, volatility is the currency equity investors must pay for long-term returns above the risk-free rate.

Moreover, stock market corrections are not a reason to panic. Rather, in many instances, temporary market declines can be helpful to one’s long-term investment performance. Case in point: Truxton has used the recent market volatility to deploy excess cash in attractive companies that are now trading at more favorable prices. In addition, we have harvested tax losses which, as we all know, were all but lost to investors last year due to the market’s steady appreciation and limited pullbacks.

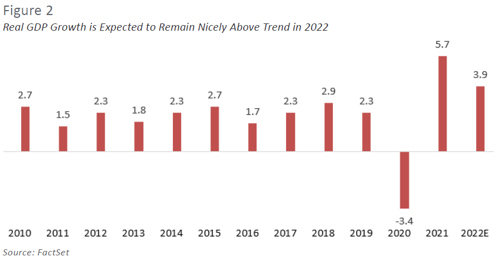

Truxton remains constructive towards the equity market for several reasons. First, we recognize economic growth in 2022 is expected to remain well above trend. Indeed, economists expect real GDP growth to approximate 3.9% this year. While down from 2021’s “bounce-back” 5.7% rate, it stands nicely above the 2.0% average recorded since 2010.

Second, the consumer remains in good shape thanks, in part, to a tight labor market and, in turn, wage rate opportunity. The unemployment rate, at 3.9% as of December 2021, has declined to nearly pre-pandemic levels, and job openings (10.9M cited by the Department of Labor as of the end of December 2021) are plentiful. At the same time, consumer balance sheets remain strong, as the ratio of household debt service to disposable income is near the record low set in 1Q21.

Finally, we remain impressed with companies’ ability to adapt and register good earnings despite the uncertain environment. In fact, while still early, we point out the calendar 4Q21 earnings season has started on relatively strong footing. Despite well-telegraphed margin headwinds, including input cost and wage inflation, roughly three-quarters of those S&P 500 companies that have reported have beaten Wall Street’s earnings forecasts for the period. In all, despite marginally higher interest rates, in our view, those dynamics accord a favorable backdrop for risk asset performance.

So, when short-term market volatility puts you on an emotional roller coaster, try to think like a kid: turn the television channel to cartoons, and remember investing is a long journey, with long-term goal realization seldomly predicated on short-term gyrations in the market. If that does not help, go hide in your fort with your favorite cookie.