A Rose and a Thorn

Executive Summary

- Anticipated Fed rate cuts have stabilized the market after a May decline.

- The U.S. economy remains in good condition led by strong employment.

- International economies and U.S. manufacturing are showing signs of stress as the trade dispute between the U.S. and China drags on.

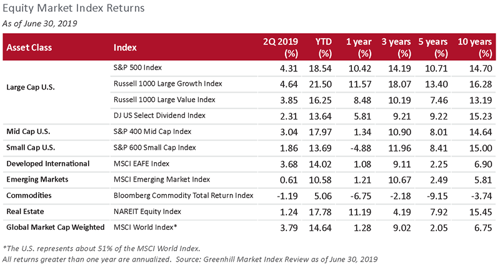

The stock market looks rosy at the end of the second quarter with new highs on the NASDAQ, Dow, and S&P 500. Global equity markets are up 14.64% year-to-date in the face of slowing global growth. While not wanting to wish away good fortune, there is a lot to consider about the path forward. In a confusing market, sometimes focusing on the basic things is best. In honor of summer camp season, we’ll use the classic conversation starter framework that camp counselors and youth directors have used over the ages to address the salient issues. Simple rules. A rose is something that you are happy about. A thorn is something that is bugging you. A bud is something you are looking forward to tomorrow.

First, the rose. The Federal Reserve has shifted 180 degrees to an accommodative stance, which has propelled the equity markets to new highs. The derivatives markets are placing 100% probability on a Fed rate cut in July and a 62% chance of a second cut in September. The anticipated rate cuts have many potential benefits. First, cheaper credit drives more economic activity, all else equal. You have to say that in economics. Second, lower rates should drive higher valuations on risk assets because the return from taking no risk is lower. There is a lot of math behind this, but the relationship is reliable. Finally, if the yield on the 10-year Treasury remains the same, the cuts should alleviate the inverted yield curve. An inverted yield curve has historically been a reliable predictor of recession, but not a perfect one. It is likely that some of the yield curve inversion is partially explained by ultra-low and negative interest rates across major developed economies which have placed downward pressure on the U.S. yield curve as global investors seek the relative attractiveness of higher U.S. interest rates. In most cases, the Fed raises overnight rates (fighting inflation) while risk averse investors are driving down the yield on the 10-year Treasury. The fourth quarter sell-off was based on indications that the Fed would do just that with one small difference. The Fed’s prior rate increases were not based on evidence of inflation as inflationary pressures have remained subdued. Rather, the Fed was looking to “normalize” rates after a period of extraordinarily accommodative monetary policy to have some ammunition to fight the next recession. The reversal is opaque, which is a departure from the very clear communication of the criteria, timing, and magnitude for Fed decisions over the last ten years. The Fed needs to be credible, which basically means there are no surprises. There are questions coming from a lot of corners, but most are going with the adage: don’t fight the Fed.

The greater Fed accommodation is a preemptive action, which brings us to the thorn. While the ultimate objective is worthwhile, trade disputes and tariffs are hurting economic growth. The greatest impact is in international markets where many economies are highly dependent on exports. Globally, Manufacturing Purchasing Managers’ Indices (PMIs) are falling fast reflecting the immediate headwind of reduced volumes and the reticence to invest in the face of uncertain future growth rates. PMIs are based on surveys that have predictive value for future manufacturing activity.

A PMI reading above 50 indicates future growth in manufacturing output, which we are seeing in only a hand full of countries at this point. Supply chains are integrated and the flow of intermediate goods to finished goods to U.S. ports is hurting. The U.S. PMI remains above 50, but the readings are falling. While the U.S. is somewhat insulated due to the predominant role that consumption plays in our economy (a little under 70%), manufacturing and investment are “swing factors” that are more volatile and significant enough to make a difference. We do export and exports are down. Domestically, the uncertainty about the trade situation is impacting investment decisions. Consumers will likely begin to feel the burden of the higher tariffs through pass through price increases, which will have some impact on consumption. We just don’t know how much.

The market is encouraged that China and the U.S. are back at the negotiating table. On a positive note, the impact of the tariffs is a burden that is both identifiable and easily lifted. It seems that equity prices reflect the assumption that resolution in some form is likely and that global growth will return to the 4% range upon resolution. We believe that is probably correct given healthy employment trends in the U.S. and abroad. Politics suggests the incentives for resolution are powerful; however, these are arguments that will impact the positioning of strategic rivals for years to come. We think it is wise to maintain some degree of skepticism until a deal is hammered out.

Second quarter earnings reports will carry a great deal of information. S&P 500 earnings estimates for 2019 were adjusted to reflect about 4% growth following fourth quarter 2018 earnings reports and 2019 guidance. Since then, estimates have drifted down to reflect 3.3% growth. The forward-looking market has accepted this anemic year as a temporary blip in a continued expansion with estimates for 2020 and 2021 reflecting growth around 10%. The May sell-off illustrates what happens when there is a break in these assumptions. Despite strong performance year-to-date, valuations have stayed within a close range of the 25-year average. The S&P 500 trades at 17.8x next 12 months’ earnings estimate versus the 15.9x average on the same basis. We continue to believe that it is best to assume a lower average return over the next few years than we have seen over the past ten, but we still believe that equities remain reasonably valued in aggregate and offer the best potential to grow wealth beyond the rate of inflation over time.

We are encouraged by strong job growth. June nonfarm payrolls re-accelerated following a weak May report. The U.S. added 225,000 jobs in June, restoring the average for 2019 to about 170,000 a month, a healthy clip. Average hourly earnings increased 3.1%, continuing a trend that is high enough to improve the standard of living, but not so high as to concern the Federal Reserve. Discouraged and disinterested job seekers are reentering the labor force. U.S. individuals and non-profits have a net worth of over $110 trillion.

Our banking system is in good shape. The June stress testing (Comprehensive Capital Analysis and Review) affirmed that U.S. banks are well enough capitalized to absorb an extreme credit event. As a result, most banks and financial institutions subject to the test increased expected return to shareholders with the Fed’s blessing. Dividend yields continue to move higher for large banks.

In all, the first half of 2019 has been good. Equities have performed very well. Fixed income has also performed well. Roses are pretty, but they wilt and fall off. Thorns are always there, but we learn to walk around them. Markets don’t dwell on yesterday’s glory and they tend to climb a wall of worry (covered by thorns) as long as there is a bud. In our opinion, there is always a lot to look forward to with equity markets because they are a window to human ingenuity. We believe that a good plan that incorporates growth opportunities and risk controls in the right proportions for an individual’s situation is the best way to achieve success despite the inevitable thorns life brings us.