Social Security for the Rich

“Let me tell you about the very rich. They are different from you and me.”

- F. Scott Fitzgerald

Fitzgerald was correct, when it comes to Social Security and Medicare; high income and high net worth Americans should think about them differently.

Almost all Americans are eligible to receive Medicare and Social Security benefits beginning in their 60’s. Social Security is the biggest source of income for most older folks but often not for people with high net worth and income. Still, maximizing benefits and minimizing taxes is worthwhile.

When to Claim Your Benefits

No high income W-2 earner should consider taking Social Security until Full Retirement Age (FRA), 67-years-old for all born in 1960 or later. As the Social Security Administration so thoughtfully notes:

“If you are younger than FRA and earn more than the yearly earnings limit, we may reduce your benefit amount.

If you are under full retirement age for the entire year, we deduct $1 from your benefit payments for every $2 you earn above the annual limit. For 2024, that limit is $22,320.”

A person making $200,000 per year will see his or her Social Security docked by $88,840 (that is, completely eliminated) if he or she claims between the ages of 62 and 67. And claiming before FRA will permanently reduce your benefits. Obviously, a terrible idea.The question of whether to claim at FRA or wait until age 70 is more subtle and less important. Waiting from age 67 until age 70 will permanently increase your benefit by about 20% but you get paid the benefit three fewer years, assuming the claiming approach does not influence the date of death! It is easy to compute the breakeven age for total cash payments, but that doesn’t answer the puzzle unless you know a) when you are going to die, b) whether you saved the money you received between 67 and 70 and c) what you earned investing it. It is a close call and, for a person with a net worth of several million, not a key question in planning. Earnest analysts of this question come to a variety of conclusions.

Much commentary on Social Security describes taking benefits at retirement, as though the end of W-2 income in some way triggers benefits. The retirement decision and the claiming decision are entirely independent, and a wealthy person may prefer to delay until age 70 even if he or she stops working several years before.

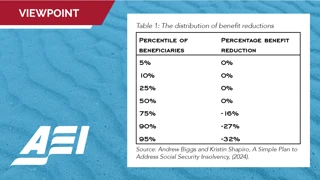

One factor to consider is political. Social Security will no longer be able to pay full benefits out of dedicated tax collections as of 2035. Some reform must prevent the reduction of benefits. A couple, each with a large income over many years, will, at age 70 receive pretax social security payments of about $120,000 per year. Reducing that benefit by claiming at FRA would get the couple three years of a lower benefit before the fiscal imbalance begins to bite. Some observers favor claiming at 62 so that you receive at least some benefits before the system collapses. That’s a) too pessimistic and b) still wrong if the claimant still has an earned income (see above).

Your New Friend IRMAA

On the Medicare side, get to know your new friend IRMAA. Since 1994 when the Congress uncapped the amounts paid in Medicare tax, high income taxpayers have paid in wildly more than middle class individuals. A couple with a combined W-2 income of $750,000 are today paying 2.9% of all their earnings ($21,750, including the “employer side”) per year in Medicare tax, almost as much as they pay toward Social Security. There is an Additional Medicare Tax of 0.9% (with no employer match) on income above $250,000 for married filing jointly.

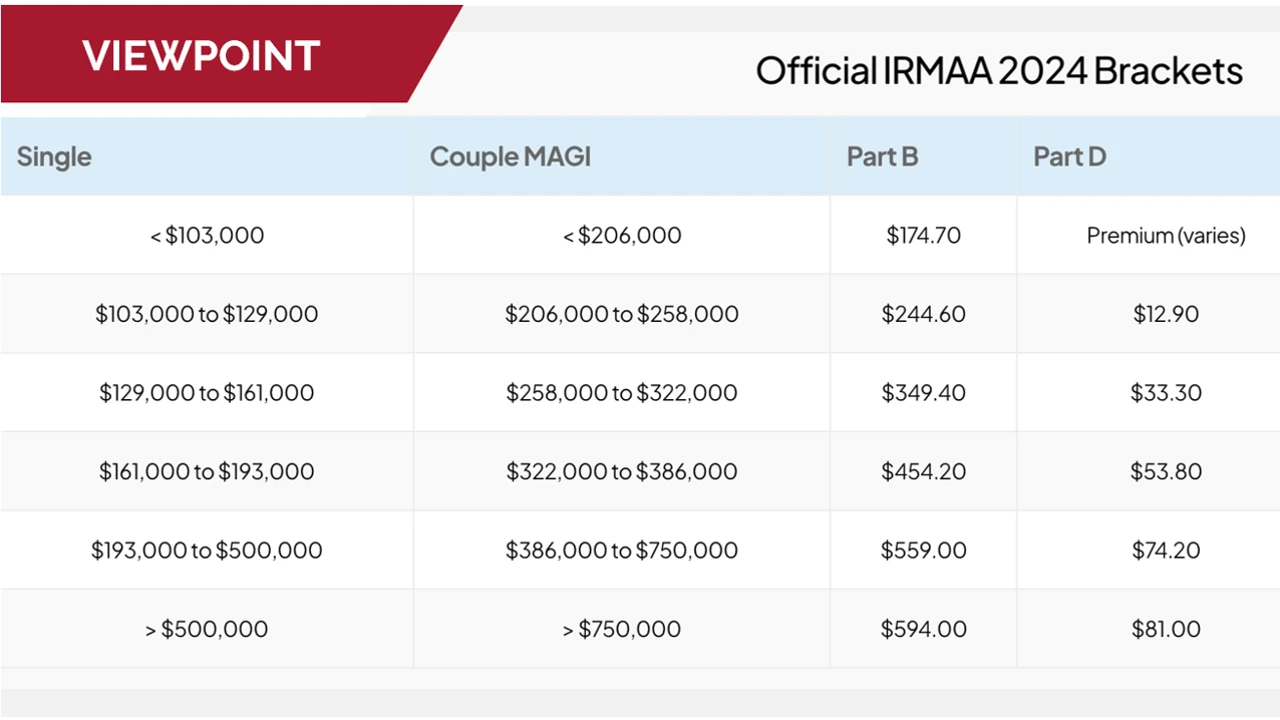

But that’s just the beginning. Very high-income seniors also pay more in Medicare Part B and D premiums once they have begun to receive the benefits they paid so handsomely for. That’s IRMAA – the Income Related Monthly Adjustment Amount. For seniors with a Modified Adjusted Gross Income (MAGI)* of $750,000 or more, Part B premiums are $594 per month and Part D $81, four times the premiums for people with small incomes. This, for the same benefits. Perhaps all of this is just and fair. Who will pay for Medicare if not the rich? But it is worth remembering how dramatic these re-distributions are today, because more are likely to come.

As a planning matter, these Medicare costs incent the high-income taxpayer to delay Medicare as long as possible. If you can maintain employer-sponsored health insurance, you need not enroll in Medicare Part B. You can enroll in Part A which has no premiums, but doing so eliminates your ability to make “HSA” contributions.

The wealthy also have some opportunities to save. Most should self-insure for long-term care. Most should stick with traditional Medicare rather than accept the narrower provider networks that come with Medicare Advantage plans. Most should buy catastrophic coverage only as a Medicare supplement. These decisions should save several thousand per year. For example, a Medicare Supplement Plan G will cost $100 to $300 per month, while a High Deductible Plan G may cost only about $50 per month. Seniors with significant net-worth and liquidity should typically prefer to self-insure the $2,800 of potential cost borne by high deductible plan subscribers. These are complex decisions and require individual study, but people generally should not insure expenses that they can easily pay out of pockets. There is always friction in the intermediation.

We’ve just scratched the surface here. High-net-worth individuals need professionals who bring deep expertise on a huge range of technical and strategic questions related to their wealth and their families. Truxton has deep expertise in these government programs and hundreds of other topics. Call us, come see us. We’d like to discuss how this knowledge might benefit you.