A Thin Line

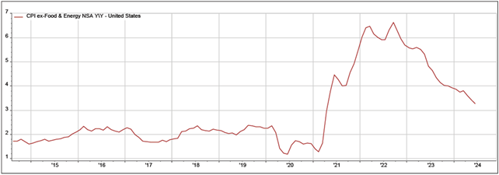

The Federal Reserve began hiking rates in March 2022 to address inflation sparked by the fiscal and monetary stimulus previously provided to limit Covid’s impact on the US economy. The Fed increased the Fed Funds rate 11 times in increments ranging from .25% to .75% over 16 months and then paused after the last hike in July 2023, at which time the overnight lending rate stood at 5.25% to 5.5%. We have been paused ever since. Meanwhile, the economy has been resilient. As the Consumer Price Index has dropped (in fits and starts), the belief that the Fed could engineer a “soft landing” had become the norm. What does that mean? The Fed has a dual-mandate to promote stable prices and full-employment. The two tend to argue with one another. When employment is very strong, higher wages tend to drive higher inflation. When rates rise to tame inflation, employment tends to suffer. A “soft landing” means that the expected adverse outcome from economic models didn’t happen. In other words, inflation comes down without significant damage to employment.

But Fed policy operates with a long and variable lag. The recent decline in stock prices reflects a possibility that the relationship between rates, inflation and employment might be the same as it ever was. We got whipsawed a little bit in July. On July 11, The Bureau of Labor Statistics reported the June CPI (ex-food and energy) rose 3.3%, below the expectation of a 3.4% increase and continuing progress toward the Fed’s 2% target. That’s good news.

On August 2, July employment disappointed. Non-farm payrolls increased 114,000, well below the 175,000 expectation. The 12-month average was about 210,000. The unemployment rate, which comes from a different survey was 4.3% versus the 4.1% expectation. The growth in payrolls was driven by Education & Health Services with slower growth or declines in many economically sensitive jobs. This is one report in a series that can be volatile and is subject to subsequent revisions, but the news caught the market in a mood.

Throughout the 12 month pause in interest rate changes, the focus has been on when the Fed would cut rates. There has been an eagerness for mediocre employment and growth on the belief that this would encourage the Fed to cut sooner. Bad news was good news. The combination of a weak ISM Manufacturing report on Thursday and the rise in unemployment raised the possibility that the Fed might be “behind the curve”. In that case, the market decided bad news was just bad news. It’s a thin line.

While there are some indications that the economy is getting a little weaker, second quarter GDP grew 2.8% reflecting strength in consumer spending, rebuilding inventories and non-residential fixed investment. The July report is subject to revisions, but the data suggest continuing economic strength. The coming months will reveal where the data converges. We believe there will be a bit of a slowdown in near-term economic activity, but do not see the makings of a severe recession.

On a side note, the Monday August 5 selloff was driven by the Bank of Japan’s (BOJ’s) surprise rate hike. For decades, but particularly as the Fed raised rates, the combination of 0% rates in Japan, relatively stable US$/ Yen foreign exchange and rising rates elsewhere drove heavy volume into the “Yen carry trade”. Prior to the BOJ rate hike, investors could borrow yen, lend (or purchase any security) in a different currency and make money. The rate hike (and related currency appreciation) after 25 years at 0% upset the scheme driving billions of dollars in liquidations to settle up. The Nikkei fell 10% and US equity markets fell the most since September 2022. Subsequent comments from the BOJ settled the market down quickly, but the event highlights the impact of rate changes in complex financial systems and the dangers of complacency.

Following a wild 2 weeks, the S&P 500 is about 2% below the all-time high achieved on July 16. The Nasdaq 100, comprised almost exclusively of high growth technology stocks has declined 6% from July 10 peak. The S&P 500 trades at 20.7x next-twelve month earnings relative to a long-term average of about 16x. Current earnings estimates forecast 10.6% growth for 2024 and 15% growth for 2025. We believe the growth expectations and healthy market multiple reflect optimism that the Fed will cut rates starting in September relieving headwinds and probably stimulating economic growth. The equity market is not at a discount these days, but there are (large) pockets with the potential to recover from the pinch of higher rates: housing, industrials, financials, consumer and even large parts of information technology. We believe it is important to be disciplined with valuations, maintain diversified portfolios and carefully consider financial and competitive strength for individual investments.

The positive side of higher rates is the best yields on bonds that we have since before the global financial crisis. The investment opportunity set is somewhat balanced. We still believe equities offer higher return opportunity, but bond yields approaching 5% are not a bad alternative with a much lower risk profile. Disciplined adherence to well-considered asset allocation targets is important to achieving long-term goals.

Finally, the news has many people concerned about many things. I don’t want to dismiss anyone’s concerns as they are real and have some basis in fact. Instead of going through the litany of concerns and trying to set minds at ease, I thought a little perspective could be provided with an excerpt from one of my favorite authors and book series:

….. The trouble with the news is that everybody knows everything too fast and too often and too many times. News has always been bad. The tiger that lives in the forest just ate your wife and kids, Joe. There are no fat grub worms under the rotten logs this year, Al. Those sickies in the village on the other side of the mountain are training hairy mammoths to stomp us flat, Pete. They nailed up two thieves and one crackpot, Mary. So devote wire service people and network people and syndication people to gathering up all the bad news they can possibly dredge and comb and scrape out of a news-tired world and have them spray it back at everybody in constant streams of electrons, and two things happen. First, we all stop listening, so they have to make it ever more horrendous to capture our attention. Secondly, we all become even more convinced that everything has gone rotten, and there is no hope at all, no hope at all……

- John D. MacDonald

A Tan and Sandy Silence

What struck me most about this excerpt was the date that the book was published: 1971. I recommend John D. MacDonald’s Travis McGee novels as entertaining stories about a bit of a drifter who probably inspired some Jimmy Buffett songs. They are basically dime novels. But John D. MacDonald was a very good writer with a surprising insight into why people do the things they do and the impact on others. I thought this was a good one for the current day. Since the days when the hero Travis McGee docked his houseboat, the “Busted Flush” at slip F-18 at Bahia Mar, the news has gotten faster and has more folks weighing in. I’m not saying that bad news isn’t really bad news, but the general concerns are the same as ever. Am I safe? Can I provide for my family? Do I have people that love me? Usually, in this great country, the answer is yes with a few items on the “to do list”. I anticipate a particularly busy news season as we head toward November’s election. I hope some perspective equips you to recognize that a lot of what you are feeling is the intended response; to believe that the next 50 years (like the last 50 years) will probably see continued progress despite headwinds; and to focus on how we treat others and our expectations for how they treat us. In my opinion, for the big things, it is not really a thin line.

Thank you for choosing Truxton. We appreciate you and are working to help you navigate a complex landscape.