Contributing Authors

Miles T. Kirkland, CFA

SVP, Portfolio Manager - Team Lead

John H. Diffendal, CFA

SVP, Portfolio Manager

Patty Love, CFA

SVP, Portfolio Manager

Mitch Van Zelfden, CFA

Portfolio Manager

Executive Summary:

- Synchronous accommodative monetary policy created strong demand globally for long duration and risk assets providing an environment for both equities and bonds to appreciate significantly and in tandem.

- As we enter a new year and decade, investors face myriad risks including the upcoming 2020 U.S. elections.

- We believe a long-term perspective and a well-defined investment process centered on risk management, tax efficiency and well-defined personal goals will help to alleviate the stress associated with sensationalized high frequency headlines.

- The ingenuity of companies, motivated by economic incentives, remains a powerful force for innovation, problem solving and wealth creation.

- We remain cautiously optimistic on the future and committed to our investment process, built on principles of conservatism and customized advisory solutions.

2019 Review

2019 was a remarkable and somewhat rare year for investors as major global asset classes appreciated significantly and in tandem. Fears of slowing global economic growth, exacerbated by trade tensions between the United States and China, caused central banks around the world to simultaneously cut key interest rates and inject substantial liquidity into the financial system. Synchronous accommodative monetary policy created strong demand globally for long duration and risk assets. 2020 will offer a multitude of reasons for investors to worry. The worries “du jour” include trade tensions, rising geopolitical tensions, the effectiveness of global monetary policy to boost real economic growth and the outcome and implications of the 2020 U.S. election. As we enter a new year and decade, we are pleased with investment results achieved, cautiously optimistic on the future and committed to our investment process built on principles of conservatism and custom advisory solutions tailored to meet our clients’ unique objectives.

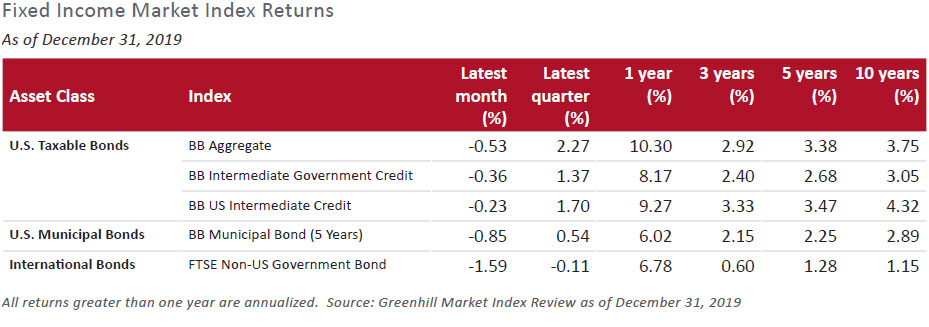

Fixed Income

Coming into 2019, Truxton’s Investment Committee did not hold the view that bonds would produce equity like results. After all, interest rates were low and the Federal Reserve (the Fed) communicated its steadfast resolve to continue its rate hiking campaign citing a strong domestic economic backdrop supported by a robust labor market and consumer. However, expectations of slowing global economic growth, fueled by trade tensions and tariffs, caused the Fed to unexpectedly reverse its rate hiking campaign and cut the Fed Funds rate three times in 2019. Many central banks around the world followed suit with further monetary accommodation in the form of rate cuts and additional bond purchases with the hope that these actions would breathe life into the real economy. The U.S., with its relatively high interest rate environment, stood and still stands as a very attractive yield alternative to other “safe haven” alternatives in Europe and Japan where trillions of dollars in bonds continue to trade in negative yield territory. As a result of the relative safety and attractive yields in the U.S., foreign investors flocked to U.S. bond markets. The effect of the Fed’s rate cuts and bond purchases by yield starved international investors produced a strong rally in bonds of all types and a flattening of the U.S. yield curve (where short and long-term rates are relatively equal) causing many broad-based U.S. fixed income indices to produce total returns well in excess of +6% for 2019. Given the low current level of interest rates, it is challenging to project that the elevated returns of 2019 will repeat in 2020 and more challenging yet that forward long-term results could reach these lofty levels. Our base case in the coming years is for interest rates to rise slowly but remain relatively low and for the shape of the yield curve to normalize. In this scenario, higher carry rates would help offset modest bond price declines. However, if international bond markets are any guide, there is a possibility that U.S. yields could fall further causing bonds to again produce strong total returns.

Fixed Income Process

Bonds are fundamentally less risky than equities as their core attributes greatly narrow the range of potential return outcomes. As such, bonds play a critical defensive role in a Truxton managed portfolio. Truxton’s bond strategy is best described as an intermediate maturity, investment grade bond ladder that evenly distributes bonds across a maturity range of 1 to 10-years. Both the intermediate maturity and investment grade orientation are designed specifically to mitigate the equity market risk in a portfolio. In other words, the bond ladder serves as the “safe” portion of the portfolio providing a level of downside protection when stocks are in flux. The laddered portfolio approach allows the investor to participate in the changes in the interest rate environment without making a bet on what rates will be… a bet that will inevitably be wrong at some point. 2019 is a prime example of the difference in the actual outcome vs. the outlook. Investing exclusively in investment grade bonds gives us confidence our bonds perform as planned and will be in demand during trying financial times. Our saying is that “the return of principal is paramount to the return on principal”. We continuously review our bond holdings for developments that could impact their credit quality and maintain broad diversification across sectors and issuers as extra measures of risk control. Truxton determines whether clients will benefit most from investing in taxable or tax-exempt bonds based on their circumstances and monitors for changes in the market or tax law that may alter the initial decision. One such change for our Tennessee resident clients is the ongoing phase out of the “Halls” tax on certain types of unearned income including interest on out of state municipal bonds. Increasingly, high income Tennessee residents may find opportunities to use out of state municipal bonds for their tax-exempt income needs.

Equities

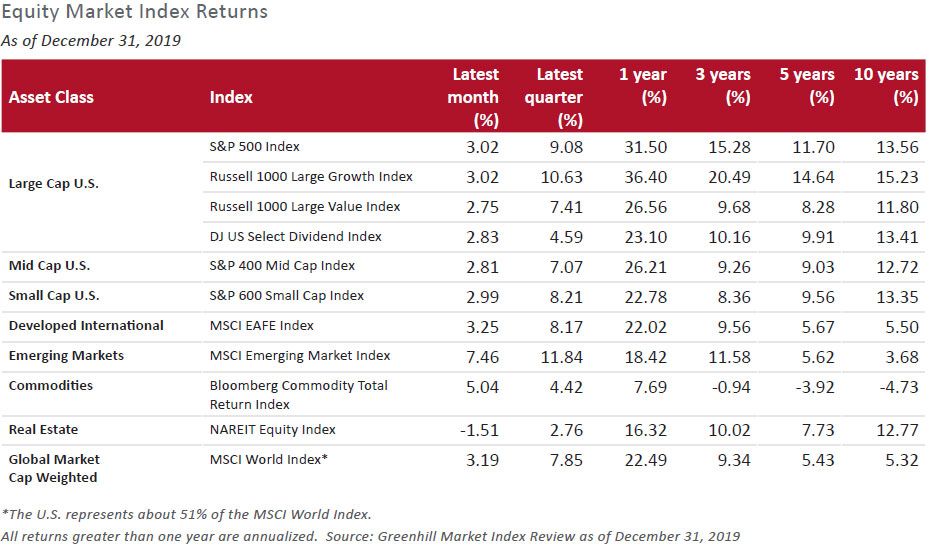

Equity investors entered 2019 filled with a sense of dread following the late 2018 correction in equity markets. However, investors who rode through 2018’s rough patch were handsomely rewarded as the S&P 500 set new all-time highs and produced a +31.49% total return for the year. The 2018/2019 period reminded us that equity market pullbacks are painful to our psyche, elicit strong emotions and sometimes costly behavioral errors, but occur regularly and are not terribly damaging with time. 2019 also served as a reminder that maintaining an overly conservative risk posture, disconnected from long-term goals, even for short periods of time, can meaningfully detract from an investor’s long-term investment results. Most of the rally in equities was explained by multiple expansion rather than earnings growth indicating heavy influence on returns from central bank accommodation. Analyst expectations for 2020 currently indicate high single digit earnings growth for the S&P 500. With equity valuations somewhat extended but not excessive, earnings growth will likely be the primary driver of equity returns for 2020. Further fueling the rally in equities late in 2019 was progress in trade negotiations between the U.S. and China and relatedly, a growing market view that the magnitude of a global economic slowdown may not be as acute as previously expected. Much is left to be learned about the U.S./China Phase 1 trade deal but we are encouraged by the more constructive tone and its potential to reduce market uncertainty and boost business sentiment and activity. While we are encouraged by recent developments, the U.S. and China still have to contend with larger, more difficult issues such as market access and intellectual property rights. These issues will not be easily resolved and are likely to persist irrespective of November’s U.S. election results. The U.S., supported by a strong consumer, robust labor market and accommodative monetary policy, appears poised to continue modest economic expansion during 2020. We continue to view the U.S. with its innovative, well diversified and resilient economy as the most fertile ground for investment opportunities around the world and our tactical equity allocation reflects this thinking. However, other areas of the world offer beneficial risk/return exposures. Having long trailed their U.S. counterparts in terms of returns, European and Emerging Markets equities offer both reasonable valuations and cyclical exposure to improvements in the trade environment. All things considered, we remain constructive on equities in the near term. Despite the potential for future equity market returns to be lower than historical averages, we believe a long-term allocation to equities will continue to compound wealth at attractive rates over the long-term. The ingenuity of companies, motivated by economic incentives, remains a powerful force for innovation, problem solving and wealth creation.

Equity Process

At Truxton, we encourage clients to adhere to a disciplined, long-term investment philosophy. We believe long-term perspective and a well-defined process will help to alleviate the stress associated with sensationalized high frequency headlines and social media posts. Truxton’s equity allocation is built with the intent to manage equity market risk on a number of different levels while broadly participating in the equity market’s long-term appreciation potential. First, we maintain exposures to a wide variety of equities (Large, Mid, Small, Domestic, International, etc.). The weighting to each is carefully calibrated based on both their anticipated volatility and potential returns. Since we seek portfolio durability across market cycles, we generally skew towards less volatile, higher quality areas of the market and use higher risk asset classes such as Small Caps and Emerging Markets stocks as complementary return enhancers. Truxton’s individual equity strategies offer another layer of risk control as our investment process focuses on companies with consistency in earnings and free cash flow growth, reasonable valuation, high quality of management, prudent levels of leverage and durability of business model. We believe our diversified portfolio of equities, each the product of rigorous fundamental analysis, and low turnover, tax-efficient trading strategies position investors to weather short-term market volatility and maximize long-term portfolio growth performance. As we enter this new decade, investors will likely be well-served to seek and hold equities of financially strong, proven companies. We remain optimistic about the return potential for companies with the ability to pay, sustain and grow their dividends over time given the low yield environment. In addition to providing an attractive income stream, these companies typically offer a level of downside protection in times of financial stress.

2020 U.S. Elections

We would be remiss if we did not directly address the 2020 U.S. elections. Afterall, elections have consequences. For investors, a better way to frame things would be: elections are emotional and emotions have consequences. Political emotions run high and can drive individuals to levels of euphoria and despair, which are projected onto individual expectations for stock market returns. However, evidence suggests that there is relatively limited near-term or long-term impact on stock market returns. In most cases, election year returns are positive. In the cases when they are not, it is easy to identify other reasons for the negative performance for the stock market. At a very basic level, investing begins with faith in the United States. Our system has worked for a long-time with a variety of different approaches to regulation, foreign policy and taxation. Warren Buffett refers to the United States having “the secret sauce,” probably because it is difficult to identify any one thing that has driven our successes. Looking back over history, the pressures and anxieties of today are certainly no worse than those surrounding other elections. The people will speak and we will be okay. That said, the tenor of this election is intense and many policy proposals recommend a very different direction. Investors are watching these proposals, specifically the ones regarding significantly higher levels of taxation and regulation. These concerns range from the economy’s rate of growth to specific policies that would impact particular industries. We expect volatility through the primary and into the November election as the candidates and electorate sort this out, starting February 4th in Iowa. Like everyone else, we will be watching and make adjustments that we believe are necessary and appropriate for our clients’ financial well-being. That said, we are thankful for our institutions and the right to vote on how best to manage them.

Core Principles

Truxton’s core advisory and investment principles are centered around our clients’ unique personal and financial goals, achieving adequate returns and managing risk prudently. These core principles have been developed and fine-tuned over many years by our outstanding and diverse team of wealth management practitioners many of which contributed to this commentary. It is these core principles that we believe will position our clients for continued success in the decades to come. We wish you a very happy new year and look forward to seeing you soon.

Contributing Authors

Miles T. Kirkland, CFA

SVP, Portfolio Manager - Team Lead

John H. Diffendal, CFA

SVP, Portfolio Manager

Patty Love, CFA

SVP, Portfolio Manager

Mitch Van Zelfden, CFA

Portfolio Manager

Executive Summary:

2019 Review

2019 was a remarkable and somewhat rare year for investors as major global asset classes appreciated significantly and in tandem. Fears of slowing global economic growth, exacerbated by trade tensions between the United States and China, caused central banks around the world to simultaneously cut key interest rates and inject substantial liquidity into the financial system. Synchronous accommodative monetary policy created strong demand globally for long duration and risk assets. 2020 will offer a multitude of reasons for investors to worry. The worries “du jour” include trade tensions, rising geopolitical tensions, the effectiveness of global monetary policy to boost real economic growth and the outcome and implications of the 2020 U.S. election. As we enter a new year and decade, we are pleased with investment results achieved, cautiously optimistic on the future and committed to our investment process built on principles of conservatism and custom advisory solutions tailored to meet our clients’ unique objectives.

Fixed Income

Coming into 2019, Truxton’s Investment Committee did not hold the view that bonds would produce equity like results. After all, interest rates were low and the Federal Reserve (the Fed) communicated its steadfast resolve to continue its rate hiking campaign citing a strong domestic economic backdrop supported by a robust labor market and consumer. However, expectations of slowing global economic growth, fueled by trade tensions and tariffs, caused the Fed to unexpectedly reverse its rate hiking campaign and cut the Fed Funds rate three times in 2019. Many central banks around the world followed suit with further monetary accommodation in the form of rate cuts and additional bond purchases with the hope that these actions would breathe life into the real economy. The U.S., with its relatively high interest rate environment, stood and still stands as a very attractive yield alternative to other “safe haven” alternatives in Europe and Japan where trillions of dollars in bonds continue to trade in negative yield territory. As a result of the relative safety and attractive yields in the U.S., foreign investors flocked to U.S. bond markets. The effect of the Fed’s rate cuts and bond purchases by yield starved international investors produced a strong rally in bonds of all types and a flattening of the U.S. yield curve (where short and long-term rates are relatively equal) causing many broad-based U.S. fixed income indices to produce total returns well in excess of +6% for 2019. Given the low current level of interest rates, it is challenging to project that the elevated returns of 2019 will repeat in 2020 and more challenging yet that forward long-term results could reach these lofty levels. Our base case in the coming years is for interest rates to rise slowly but remain relatively low and for the shape of the yield curve to normalize. In this scenario, higher carry rates would help offset modest bond price declines. However, if international bond markets are any guide, there is a possibility that U.S. yields could fall further causing bonds to again produce strong total returns.

Fixed Income Process

Bonds are fundamentally less risky than equities as their core attributes greatly narrow the range of potential return outcomes. As such, bonds play a critical defensive role in a Truxton managed portfolio. Truxton’s bond strategy is best described as an intermediate maturity, investment grade bond ladder that evenly distributes bonds across a maturity range of 1 to 10-years. Both the intermediate maturity and investment grade orientation are designed specifically to mitigate the equity market risk in a portfolio. In other words, the bond ladder serves as the “safe” portion of the portfolio providing a level of downside protection when stocks are in flux. The laddered portfolio approach allows the investor to participate in the changes in the interest rate environment without making a bet on what rates will be… a bet that will inevitably be wrong at some point. 2019 is a prime example of the difference in the actual outcome vs. the outlook. Investing exclusively in investment grade bonds gives us confidence our bonds perform as planned and will be in demand during trying financial times. Our saying is that “the return of principal is paramount to the return on principal”. We continuously review our bond holdings for developments that could impact their credit quality and maintain broad diversification across sectors and issuers as extra measures of risk control. Truxton determines whether clients will benefit most from investing in taxable or tax-exempt bonds based on their circumstances and monitors for changes in the market or tax law that may alter the initial decision. One such change for our Tennessee resident clients is the ongoing phase out of the “Halls” tax on certain types of unearned income including interest on out of state municipal bonds. Increasingly, high income Tennessee residents may find opportunities to use out of state municipal bonds for their tax-exempt income needs.

Equities

Equity investors entered 2019 filled with a sense of dread following the late 2018 correction in equity markets. However, investors who rode through 2018’s rough patch were handsomely rewarded as the S&P 500 set new all-time highs and produced a +31.49% total return for the year. The 2018/2019 period reminded us that equity market pullbacks are painful to our psyche, elicit strong emotions and sometimes costly behavioral errors, but occur regularly and are not terribly damaging with time. 2019 also served as a reminder that maintaining an overly conservative risk posture, disconnected from long-term goals, even for short periods of time, can meaningfully detract from an investor’s long-term investment results. Most of the rally in equities was explained by multiple expansion rather than earnings growth indicating heavy influence on returns from central bank accommodation. Analyst expectations for 2020 currently indicate high single digit earnings growth for the S&P 500. With equity valuations somewhat extended but not excessive, earnings growth will likely be the primary driver of equity returns for 2020. Further fueling the rally in equities late in 2019 was progress in trade negotiations between the U.S. and China and relatedly, a growing market view that the magnitude of a global economic slowdown may not be as acute as previously expected. Much is left to be learned about the U.S./China Phase 1 trade deal but we are encouraged by the more constructive tone and its potential to reduce market uncertainty and boost business sentiment and activity. While we are encouraged by recent developments, the U.S. and China still have to contend with larger, more difficult issues such as market access and intellectual property rights. These issues will not be easily resolved and are likely to persist irrespective of November’s U.S. election results. The U.S., supported by a strong consumer, robust labor market and accommodative monetary policy, appears poised to continue modest economic expansion during 2020. We continue to view the U.S. with its innovative, well diversified and resilient economy as the most fertile ground for investment opportunities around the world and our tactical equity allocation reflects this thinking. However, other areas of the world offer beneficial risk/return exposures. Having long trailed their U.S. counterparts in terms of returns, European and Emerging Markets equities offer both reasonable valuations and cyclical exposure to improvements in the trade environment. All things considered, we remain constructive on equities in the near term. Despite the potential for future equity market returns to be lower than historical averages, we believe a long-term allocation to equities will continue to compound wealth at attractive rates over the long-term. The ingenuity of companies, motivated by economic incentives, remains a powerful force for innovation, problem solving and wealth creation.

Equity Process

At Truxton, we encourage clients to adhere to a disciplined, long-term investment philosophy. We believe long-term perspective and a well-defined process will help to alleviate the stress associated with sensationalized high frequency headlines and social media posts. Truxton’s equity allocation is built with the intent to manage equity market risk on a number of different levels while broadly participating in the equity market’s long-term appreciation potential. First, we maintain exposures to a wide variety of equities (Large, Mid, Small, Domestic, International, etc.). The weighting to each is carefully calibrated based on both their anticipated volatility and potential returns. Since we seek portfolio durability across market cycles, we generally skew towards less volatile, higher quality areas of the market and use higher risk asset classes such as Small Caps and Emerging Markets stocks as complementary return enhancers. Truxton’s individual equity strategies offer another layer of risk control as our investment process focuses on companies with consistency in earnings and free cash flow growth, reasonable valuation, high quality of management, prudent levels of leverage and durability of business model. We believe our diversified portfolio of equities, each the product of rigorous fundamental analysis, and low turnover, tax-efficient trading strategies position investors to weather short-term market volatility and maximize long-term portfolio growth performance. As we enter this new decade, investors will likely be well-served to seek and hold equities of financially strong, proven companies. We remain optimistic about the return potential for companies with the ability to pay, sustain and grow their dividends over time given the low yield environment. In addition to providing an attractive income stream, these companies typically offer a level of downside protection in times of financial stress.

2020 U.S. Elections

We would be remiss if we did not directly address the 2020 U.S. elections. Afterall, elections have consequences. For investors, a better way to frame things would be: elections are emotional and emotions have consequences. Political emotions run high and can drive individuals to levels of euphoria and despair, which are projected onto individual expectations for stock market returns. However, evidence suggests that there is relatively limited near-term or long-term impact on stock market returns. In most cases, election year returns are positive. In the cases when they are not, it is easy to identify other reasons for the negative performance for the stock market. At a very basic level, investing begins with faith in the United States. Our system has worked for a long-time with a variety of different approaches to regulation, foreign policy and taxation. Warren Buffett refers to the United States having “the secret sauce,” probably because it is difficult to identify any one thing that has driven our successes. Looking back over history, the pressures and anxieties of today are certainly no worse than those surrounding other elections. The people will speak and we will be okay. That said, the tenor of this election is intense and many policy proposals recommend a very different direction. Investors are watching these proposals, specifically the ones regarding significantly higher levels of taxation and regulation. These concerns range from the economy’s rate of growth to specific policies that would impact particular industries. We expect volatility through the primary and into the November election as the candidates and electorate sort this out, starting February 4th in Iowa. Like everyone else, we will be watching and make adjustments that we believe are necessary and appropriate for our clients’ financial well-being. That said, we are thankful for our institutions and the right to vote on how best to manage them.

Core Principles

Truxton’s core advisory and investment principles are centered around our clients’ unique personal and financial goals, achieving adequate returns and managing risk prudently. These core principles have been developed and fine-tuned over many years by our outstanding and diverse team of wealth management practitioners many of which contributed to this commentary. It is these core principles that we believe will position our clients for continued success in the decades to come. We wish you a very happy new year and look forward to seeing you soon.