Washington Irving’s 1819 classic short story featured a man that, after becoming intoxicated with “spiritual” spirits, slept for twenty years and, in turn, missed many of his life’s key events. Imagine, for a second, if one had the opportunity to take a “Rip Van Winkle-type” sleep and essentially fast-forward a particular year. Would one? If so, it may not be difficult to argue this past year would be on many persons’ short lists, owing to the large-scale exertions 2020 brought.

For us, however? No, thank you.

It is important to remember while Rip Van Winkle slept through many of his periods’ struggles, namely the suffering and horrors of the American Revolutionary War, he missed out on many of his life’s positive changes, both personal, such as the growth of his children, and communal, such as the founding of our great nation. To us, this past year invokes a similar message.

After a ho-hum start to 2020, the world’s population took shelter from an unseen enemy in the early spring. Without a viable vaccine or other therapy on hand, lockdown efforts were enforced and schools and businesses closed as actions to curtail the novel coronavirus’ spread. Populations were forced to adapt suddenly, and many lives were lost, upended or perhaps changed permanently. Meanwhile, investors flocked to the safety of government bonds and liquid instruments, largely at the expense of risk assets, as market participants assessed the scope and duration of economic consequences from said measures. The S&P 500 cratered as much as 34%, with little regard for winners and losers, before finally finding a bottom on March 23. At the time, prospects were bleak, and there was little visibility as to how long that “new normal” would last.

But to “fast-forward” would mean one would have ignored the incredible human ingenuity that, once again, quickly reminded us of the light at the end of the tunnel. Not only were the world’s resources successful in the development of multiple effective vaccines, but also accomplished the endeavors in time-setting fashion. Indeed, government agencies have directed the public to expect the mass availability of Covid-19 vaccines by the second quarter of 2021. Consumer confidence, investor psyche and the equity markets have all responded favorably to the developments. The S&P 500 recently established a new, all-time high, appreciating roughly 60% from the said March 23 low.

There were many other positive developments in 2020 worthy of mention. For one, the pandemic broadly highlighted the resilience and adaptability of many existing companies. At the pandemic’s onset, management teams tapped short-term liquidity facilities, slashed dividends and share buyback plans and cut operational costs. While these measures were initially painful for shareholders and some employees, they enabled many companies to not only effectively weather the uncertain environment, but also exit the year in a relatively strong financial position. Indeed, several have already reversed many of those “survival” actions, including re-establishing shareholder return packages and re-hiring furloughed workers. Next, 2020 saw the emergence, growth and investment opportunity in new(er) business models, such as ubiquitous/virtual communication and telehealth. These innovative business models have enabled society to enjoy new efficiencies and some degree of continuity. Finally, Truxton Trust was not by any means caught flat-footed during 2020. As we stated in earlier client outreach editions, we took several proactive moves to manage risk, improve asset quality, harvest tax losses and position portfolios for an economic rebound, actions we believe have paid off for the wealth of our client base.

To sum up, 2020 saw many rarely seen events, notably the coordinated efforts of governments and private sectors to develop a vaccine in record time as well as the convergence of Jupiter and Saturn (a once-in-800 year-event). "Sleeping" through these experiences would rob us of the satisfaction of accomplishment and prevent personal and societal growth. Facing and addressing challenges is what makes life interesting.

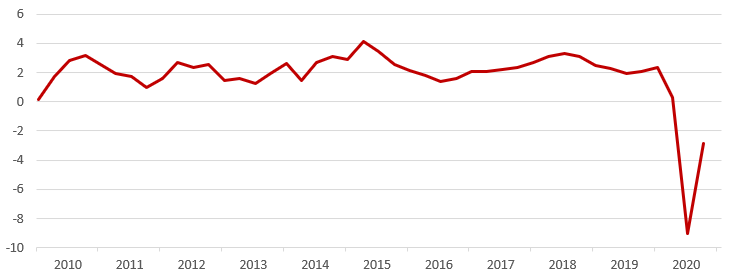

As we look ahead to 2021, several Wall Street prognosticators have published annual outlook pieces, with the consensus estimate calling for a 2021 year-end S&P 500 price target of about 4,040, some 9% above the index’s closing price on January 5. While history tells us to take such a forecast with a grain of salt (look at this past year, for instance), we recognize the healthy backdrop in place for positive risk asset performance. In particular, we note accommodative central bank policies, including the near-zero interest rate environment, vaccine discovery and distribution optimism and overall better economic growth prospects. In fact, many economists expect 2021 real GDP growth to surpass 4%, a level not reached since 2000. While strong, it is good to put that rate into perspective, as it is expected to come on top of the largest divot in real GDP growth since the Great Financial Crisis (for reference, real GDP is expected to decline roughly 3.6% in 2020).

US GDP Real Growth (YoY%)

Source: FactSet Research

That said, the market and economy are not out of the woods yet. First, investors are grappling with still-elevated unemployment, an uncertain direction for consumer spending, and the possibility of a difficult winter/early spring season from relatively high coronavirus transmission rates. Second, 2021 will usher in a new Presidential cycle, complete with new policy action (or inaction?). Third, with the S&P 500 trading at 22x next year’s earnings estimate, well above the historical, 5-year average of 17x, we concede some “pull forward” of future returns has, to some extent, already materialized. Moreover, the “E” in that P/E has been methodically ratcheted up over the past several months, as the case for economic recovery has gained steam. Currently, the Wall Street consensus expects 22% S&P 500 earnings growth in 2021 (versus an estimated 16% decline in 2020). While visibility remains relatively low with regard to the path earnings growth could take in 2021, that consensus forecast discounts an almost full recovery scenario in a one-year timespan, providing a relatively high bar for the market to meet. Finally, with the unprecedented monetary and fiscal policy measures that accompanied 2020, we believe the “inflation and repayment of debt” conversation may be thrust onto the front burner, perhaps as early as the second half of 2021.

Whatever 2021 has in store, rest assured Truxton Trust will remain “awake” and proactive in assessing all portfolio opportunities for our clients.

We wish you and your family a prosperous new year.

Washington Irving’s 1819 classic short story featured a man that, after becoming intoxicated with “spiritual” spirits, slept for twenty years and, in turn, missed many of his life’s key events. Imagine, for a second, if one had the opportunity to take a “Rip Van Winkle-type” sleep and essentially fast-forward a particular year. Would one? If so, it may not be difficult to argue this past year would be on many persons’ short lists, owing to the large-scale exertions 2020 brought.

For us, however? No, thank you.

It is important to remember while Rip Van Winkle slept through many of his periods’ struggles, namely the suffering and horrors of the American Revolutionary War, he missed out on many of his life’s positive changes, both personal, such as the growth of his children, and communal, such as the founding of our great nation. To us, this past year invokes a similar message.

After a ho-hum start to 2020, the world’s population took shelter from an unseen enemy in the early spring. Without a viable vaccine or other therapy on hand, lockdown efforts were enforced and schools and businesses closed as actions to curtail the novel coronavirus’ spread. Populations were forced to adapt suddenly, and many lives were lost, upended or perhaps changed permanently. Meanwhile, investors flocked to the safety of government bonds and liquid instruments, largely at the expense of risk assets, as market participants assessed the scope and duration of economic consequences from said measures. The S&P 500 cratered as much as 34%, with little regard for winners and losers, before finally finding a bottom on March 23. At the time, prospects were bleak, and there was little visibility as to how long that “new normal” would last.

But to “fast-forward” would mean one would have ignored the incredible human ingenuity that, once again, quickly reminded us of the light at the end of the tunnel. Not only were the world’s resources successful in the development of multiple effective vaccines, but also accomplished the endeavors in time-setting fashion. Indeed, government agencies have directed the public to expect the mass availability of Covid-19 vaccines by the second quarter of 2021. Consumer confidence, investor psyche and the equity markets have all responded favorably to the developments. The S&P 500 recently established a new, all-time high, appreciating roughly 60% from the said March 23 low.

There were many other positive developments in 2020 worthy of mention. For one, the pandemic broadly highlighted the resilience and adaptability of many existing companies. At the pandemic’s onset, management teams tapped short-term liquidity facilities, slashed dividends and share buyback plans and cut operational costs. While these measures were initially painful for shareholders and some employees, they enabled many companies to not only effectively weather the uncertain environment, but also exit the year in a relatively strong financial position. Indeed, several have already reversed many of those “survival” actions, including re-establishing shareholder return packages and re-hiring furloughed workers. Next, 2020 saw the emergence, growth and investment opportunity in new(er) business models, such as ubiquitous/virtual communication and telehealth. These innovative business models have enabled society to enjoy new efficiencies and some degree of continuity. Finally, Truxton Trust was not by any means caught flat-footed during 2020. As we stated in earlier client outreach editions, we took several proactive moves to manage risk, improve asset quality, harvest tax losses and position portfolios for an economic rebound, actions we believe have paid off for the wealth of our client base.

To sum up, 2020 saw many rarely seen events, notably the coordinated efforts of governments and private sectors to develop a vaccine in record time as well as the convergence of Jupiter and Saturn (a once-in-800 year-event). "Sleeping" through these experiences would rob us of the satisfaction of accomplishment and prevent personal and societal growth. Facing and addressing challenges is what makes life interesting.

As we look ahead to 2021, several Wall Street prognosticators have published annual outlook pieces, with the consensus estimate calling for a 2021 year-end S&P 500 price target of about 4,040, some 9% above the index’s closing price on January 5. While history tells us to take such a forecast with a grain of salt (look at this past year, for instance), we recognize the healthy backdrop in place for positive risk asset performance. In particular, we note accommodative central bank policies, including the near-zero interest rate environment, vaccine discovery and distribution optimism and overall better economic growth prospects. In fact, many economists expect 2021 real GDP growth to surpass 4%, a level not reached since 2000. While strong, it is good to put that rate into perspective, as it is expected to come on top of the largest divot in real GDP growth since the Great Financial Crisis (for reference, real GDP is expected to decline roughly 3.6% in 2020).

US GDP Real Growth (YoY%)

Source: FactSet Research

That said, the market and economy are not out of the woods yet. First, investors are grappling with still-elevated unemployment, an uncertain direction for consumer spending, and the possibility of a difficult winter/early spring season from relatively high coronavirus transmission rates. Second, 2021 will usher in a new Presidential cycle, complete with new policy action (or inaction?). Third, with the S&P 500 trading at 22x next year’s earnings estimate, well above the historical, 5-year average of 17x, we concede some “pull forward” of future returns has, to some extent, already materialized. Moreover, the “E” in that P/E has been methodically ratcheted up over the past several months, as the case for economic recovery has gained steam. Currently, the Wall Street consensus expects 22% S&P 500 earnings growth in 2021 (versus an estimated 16% decline in 2020). While visibility remains relatively low with regard to the path earnings growth could take in 2021, that consensus forecast discounts an almost full recovery scenario in a one-year timespan, providing a relatively high bar for the market to meet. Finally, with the unprecedented monetary and fiscal policy measures that accompanied 2020, we believe the “inflation and repayment of debt” conversation may be thrust onto the front burner, perhaps as early as the second half of 2021.

Whatever 2021 has in store, rest assured Truxton Trust will remain “awake” and proactive in assessing all portfolio opportunities for our clients.

We wish you and your family a prosperous new year.